kansas sales tax exemption certificate

Is exempt from Kansas sales and compensating use tax for the following reason. This notice is available by calling 785-368-8222 or from our web site.

What Is A Sales Tax Exemption Certificate And How Do I Get One

Your Kansas Tax Registration Number.

. 1320 Research Park Drive Manhattan Kansas 66502 785 564-6700. Accessibility Policy Contact Web Master Terms of Use. Ad Fill out a simple online application now and receive yours in under 5 days.

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kansas sales tax. These tax entity exemption. Ad New State Sales Tax Registration.

2012-2016 Department of Agriculture Office Use. Certificate which can be provided to any vendorsupplier that shows KDA is exempt from sales tax. The certificates will need to be renewed on the departments website.

If you are accessing our site for the first time select the Register Now button below. KS Policy from 10012019 to 6302021 Remote sellers with no physical presence in Kansas are required to collect and remit the applicable sales or use tax on sales delivered into Kansas as provided under the constitution and laws of the United States. Secretary Burghart has more than 35 years of experience combined between private and public service in tax law.

You can download a PDF of the Kansas Streamlined Sales Tax Certificate of Exemption Form SST on this page. Sales Tax Entity Exemption Certificate Renewal On November 1 2014 the sales tax exemption certificate issued by the Kansas Department of Revenue will expire. The renewal process will be available after June 16th.

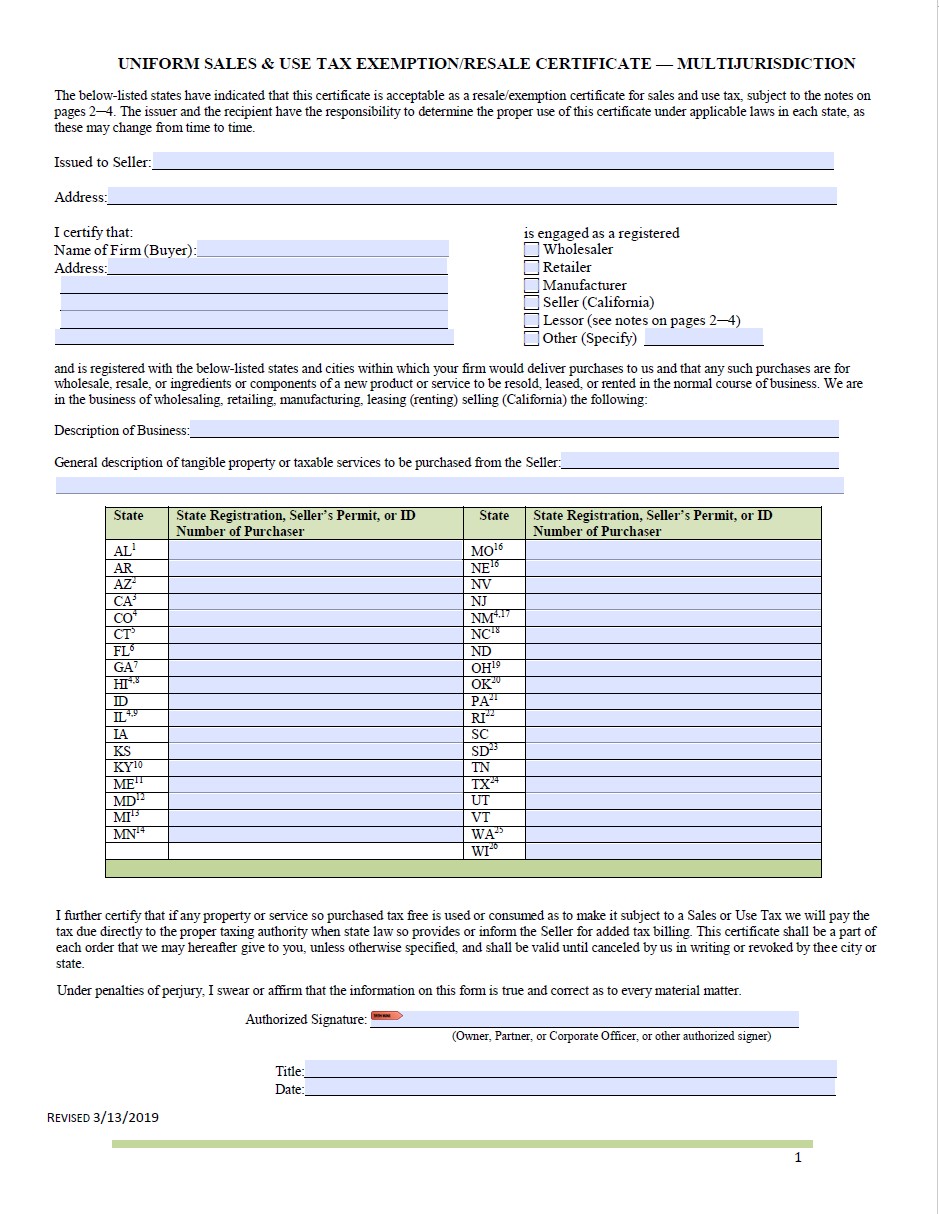

Wholesalers and buyers from other states not registered in Kansas should use the Multi-Jurisdiction Exemption Certificate Form ST-28M to purchase their inventory. Exemption Certificate Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify. Street RR or P.

Box City State Zip 4. In Kansas certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Sellers should retain a.

Effective July 1 2022 purchasers which includes contractors may use this certificate to purchase tangible personal property necessary to construct reconstruct repair or replace any fence used to enclose land devoted to agriculture use exempt from Kansas sales tax. This sales tax exemption is in the Kansas Department of Revenues Notice 00-08 Kansas Exemption for Manufacturing Machinery Equipment as Expanded by KSA. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

A Kansas resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to purchase goods from a supplier that are intended to be resold. How to use sales tax exemption certificates in Kansas. For other Kansas sales tax exemption certificates go here.

Enter the Confirmation Number provided on the Certificate of Tax Clearance C000-0000-0000. He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the University of Missouri at Kansas City in 1984. Email Address The email address you used when registering.

A Kansas business can receive an exemption from sales tax on all tangible personal property or services purchased for the construction reconstruction enlarging or remodeling of a business that has been certified through the High Performance Incentive Program HPIP. Thank you for using Kansas Department of Revenue Customer Service Center to manage your Department of Revenue accounts. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Kansas sales tax.

Kansas Sales Tax Exemption Certificate information registration support. Burghart is a graduate of the University of Kansas. You can download a PDF of the Kansas Contractor Retailer Exemption Form ST-28W on this page.

Issued first to Kansas-based entities. Remote Seller Compliance Date. Ad Register and Subscribe Now to work on your KS Resale Exemption Cert more fillable forms.

HOWEVER if the inventory item purchased by an out-of-state retailer who has sales tax nexus with Kansas is drop shipped to a Kansas location the out-of-state retailer must provide to the third party vendor a. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. The undersigned purchaser certifies that the tangible personal property or services purchased from.

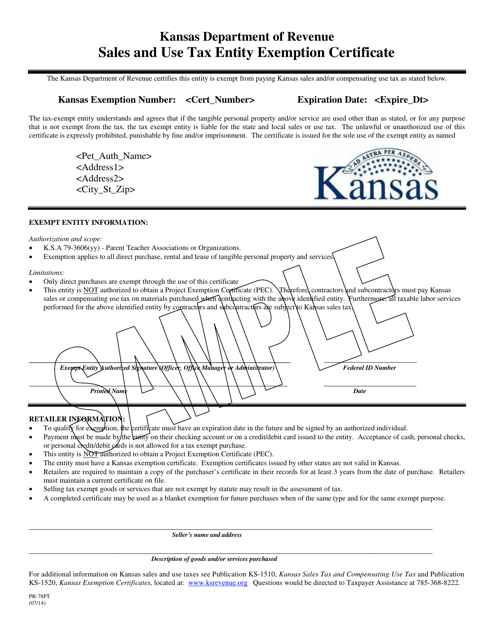

The new certificates have an expiration date of October 1 2020. The information contained in this. The certificates include a unique Kansas exemption number contain the name and address of the exempt entity and have a certificate expiration date.

Additional Remote Seller Information. For other Kansas sales tax exemption certificates go here. While groceries are not tax exempt any food that is used to provide meals for the elderly or homebound is considered to be exempt.

Tax-Exempt Entity Exemption Certificates Forms PR-78 To assist retailers in identifying the nonprofit entities exempt from paying Kansas sales and use tax the Kansas Department of Revenue has issued Tax-Exempt Entity Exemption Certificates effective January 1 2005. All construction materials and prescription drugs including prosthetics and devices used to increase mobility are considered to be exempt. Password Passwords are case sensitive.

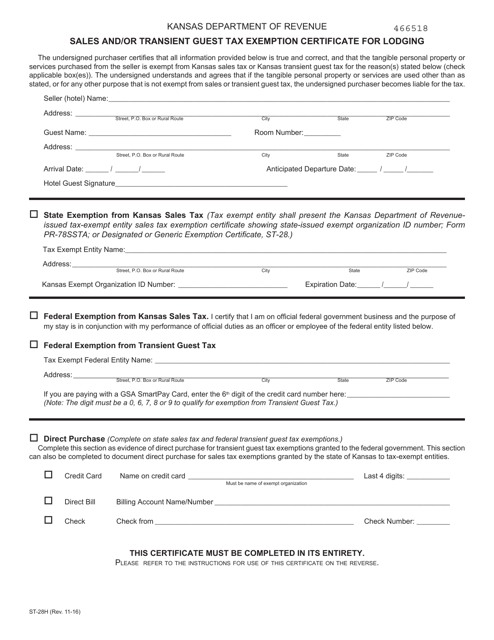

Form St 28h Download Fillable Pdf Or Fill Online Sales And Or Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller

Fillable Form Dl 14a Texas Drivers License Application Edit Sign Download In Pdf Pdfrun

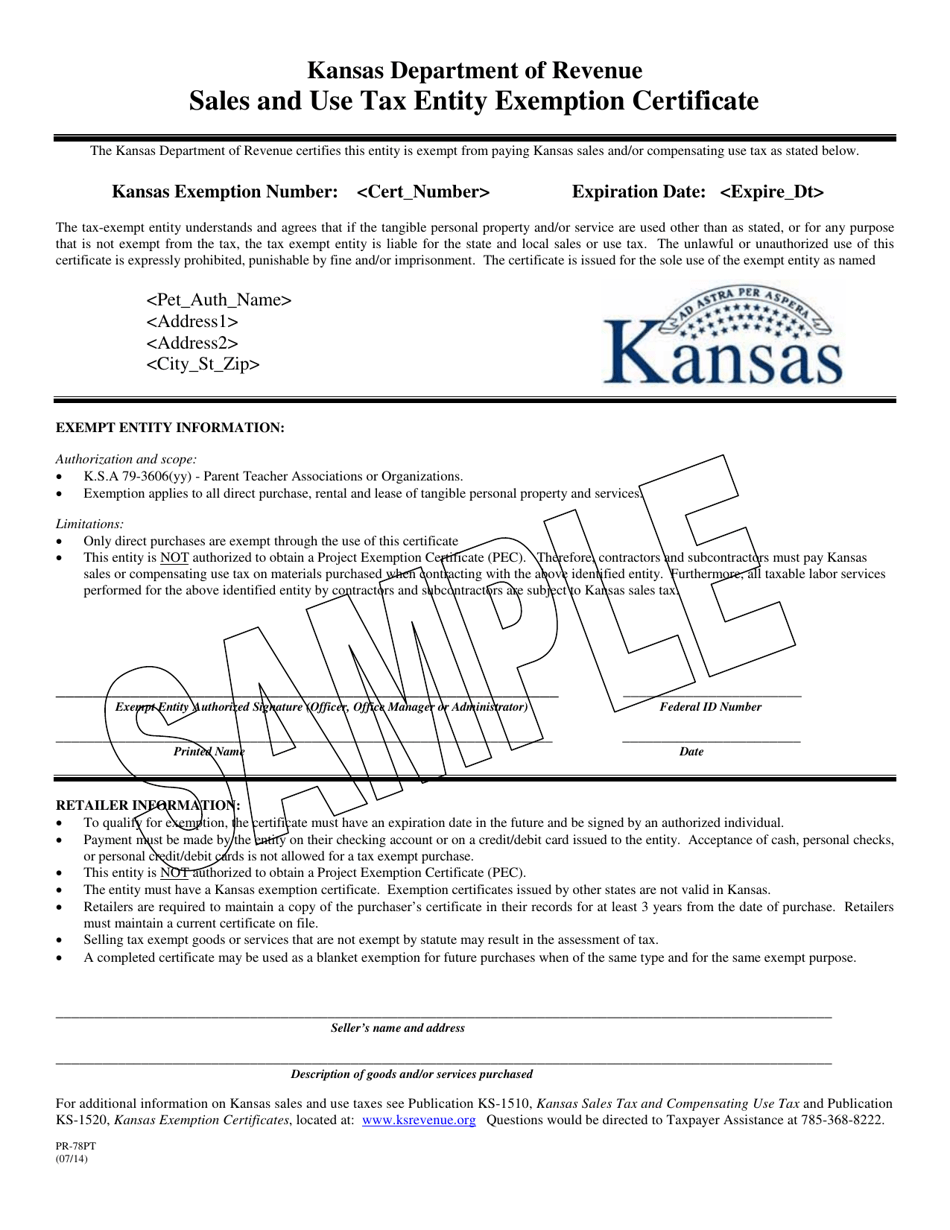

Form Pr 78pt Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Parent Teacher Association Sample Kansas Templateroller

Form St 28h Download Fillable Pdf Or Fill Online Sales And Or Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller

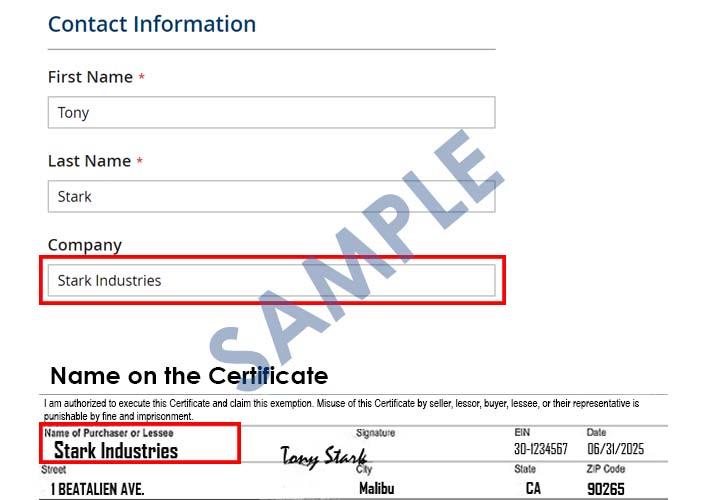

How To Register For A Tax Exempt Id The Home Depot Pro

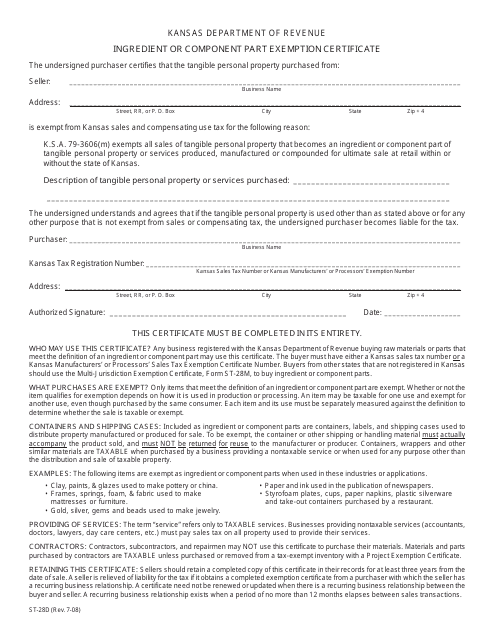

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

Form Pr 78pt Download Printable Pdf Or Fill Online Sales And Use Tax Entity Exemption Certificate Parent Teacher Association Sample Kansas Templateroller